Are digital payments set to become mainstream?

Estimated reading time: 5 minutes

The industry data all says the same thing: the COVID era sent digital payments rocketing. Let’s look more closely at the numbers – and consider what’s next for online commerce and consumer behaviours…

When contactless cards were introduced in 2007, everyone assumed that consumers would adopt them for reasons of convenience. They did, to a degree. But after 2020, a new factor emerged: hygiene. When the pandemic struck, some people thought touching a PIN pad might make them sick. They saw contactless cards as a safer way to make payments. In fact, 78 per cent of global consumers say they have adjusted the way they pay for items because of intensified safety concerns.

According to Mastercard, contactless transactions grew 40 percent during the first quarter of the pandemic. This was a larger shift to digital payment channels in 10 weeks than in the preceding five years.

In parallel, the use of cash declined. The total number of ATM cash withdrawals across EU countries fell by 24.41 per cent from 2019 to 2020.

Digital payment – it comes in many flavours

Contactless card payment is just one facet of a much wider transition away from physical cash as 'card not present' online shopping has become mainstream. The various forms of digital payment include:

• Mobile apps or web sites that store a customer’s card or bank account details in order to process payments in the background.

• Contactless payments made by a smartphone. Here, a mobile wallet – Apple Pay for example – stores multiple credit, debit and store cards. Users select the digital card before making the payment at the point of sale (POS). These digital cards are created by tokenizing a physical card, a technology standardized by EMVco and adopted worldwide.

• QR code payments that are scanned with a mobile camera. An app or mobile wallet identifies the code and opens a push notification that the user can click to complete the transaction. This method is widely used in China, but is also available via Western giants such as Square.

Has digital commerce saved nine in ten small businesses?

All of the above payment methods offer more convenience and less friction to consumers. But it's pretty clear that retailers favour these channels too. In fact, there is evidence that, during the pandemic, digital commerce saved many under-pressure vendors.

According to the 2022 Back to Business Study by Visa, 90 percent of small businesses with an online presence said their survival through the pandemic was due to increased efforts to sell via e-commerce. They added that, on average, just over half of their revenue (52 percent) came from online channels in the three months prior to the survey.

And even those retailers with a physical presence are migrating their businesses away from cash. 59 per cent said they plan to shift to using only digital payments within the next two years, or are already cashless. By contrast, just 16 percent said they will never make the shift to digital payments only.

These sentiments confirm that a huge transition is under way. Cash is declining. Physical retail is consolidating. We are close the point at which digital commerce stops being digital commerce and becomes, simply, commerce.

The key challenges to a flourishing digital payment future: fraud and friction

The following considerations are paramount to the adoption of new digital payment solutions

• Consumer protection. Consumers want reassurance that their personal payment data are protected

• Frictionless journeys. Retailers need to provide a frictionless payment journey to reduce abandoned checkouts

• Speedy transactions. Payment services providers want to be able to approve valid transactions instantly – and just as quickly identify and reject fraudulent ones

• Good UX. Fraud levels must be reduced, but not at the expense of a good user experience

The good news is that for in-store payments (using an EMV card with a secure chip), fraud levels are under control. Instead, most fraud now occurs online where the card’s chip cannot be used. Fraudsters devise elaborate methods – social engineering, phishing, identity theft – to acquire an individual's log in and account details.

Indeed, according to analysts, fraud attempts spiked upwards by almost 35 percent during the first half of 2020.

The payments industry is addressing these challenges. One of the key breakthroughs is the adoption of card tokenization. Here, the payment provider replaces the card's full number with an undecipherable token. This can be stored in the same size and format as the original data. EMV tokenization eliminates any 'man in the middle' attack. Only the bank/card scheme holds the full payment data; these details are never exposed even if the retailer experiences a data breach.

The process makes life easier for cardholders too. Tokens do not expire. Any existing token can simply be carried over to a new card when the old one expires.

Multi-factor, strong customer authentication solutions needed

The payment industry is now addressing the need for new thinking around customer authentication. So are governments. Regulations such as PSD2 in Europe mandate a strong, multi-factor approach. The factors can include biometrics (as the ‘inherence’ factor) combined with password (knowledge) and devices (possession). Used together they drastically improve security while preserving a good user experience.

In March 2022, the FIDO Alliance, an industry association for authentication specialists, published a white paper that outlined an alternative solution. Its concept puts the mobile phone at the centre of the process.

FIDO proposes that phone makers implement a “FIDO credential” manager in the handset, which stores unique cryptographic keys. The effect? To make the phone itself the ‘roaming authenticator’, with all secure information being stored locally and protected behind either a user's biometrics or unique PIN.

In practice, this means a user logs into a site and the company detects that a user’s device supports FIDO. A pop-up then asks if he or she would like to sign in via the device’s PIN or biometric from now on.

FIDO believes the process is safer, and also much more convenient. "Users don’t need passwords anymore,” says the white paper. “As (people) move from device to device, their FIDO credentials are already there, ready to be used.”

Innovation is not just confined to the online payments space. In the area of in-store payments, there’s the biometric pre-paid debit card. Users can top it up without a bank account, and authenticate a payment with a simple fingerprint. The biometric element makes the card easier to use and harder to steal.

The inclusion factor – making digital payment available to everyone

While it's important to focus on technical improvements to digital payments, we should not forget social questions – not least, how can we ensure that marginalised groups can fully participate in the digital future too?

After all, there is evidence that new forms of payment can improve lives by reducing the risks of embezzlement, theft and extortion that come with cash.

One high profile scheme to support digital financial inclusion is the UN's Better than Cash Alliance. It helps countries without an established digital payments infrastructure to deliver digital payment concepts such as electronic vouchers, prepaid cards, mobile money, and direct bank transfers.

Mobile wallet transactions expected to explode

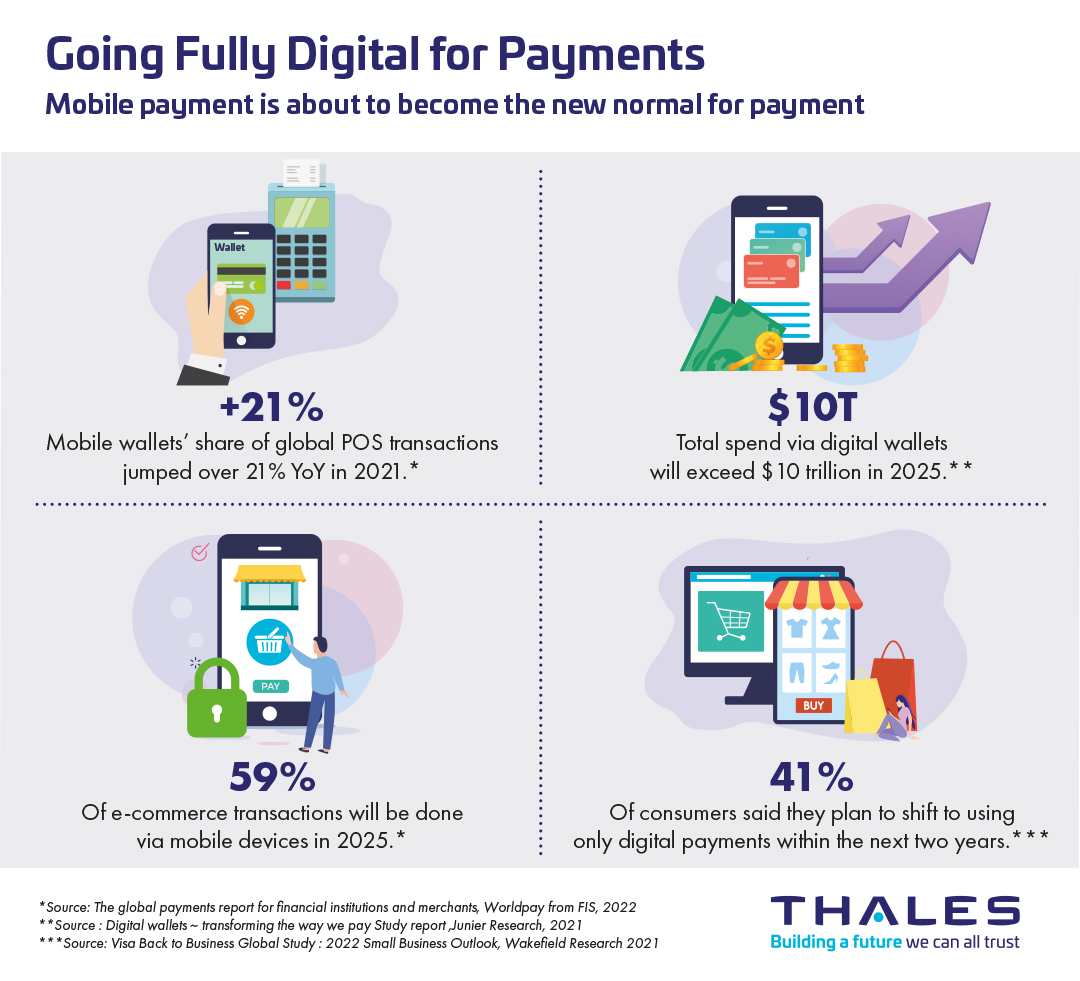

All over the world, online commerce and digital payment is exploding. The analysts’ projections are all pointing steeply up. According to Juniper Research, shoppers will spend $10 trillion via digital wallets by 2025.

The new consumer behaviours that emerged during the pandemic are here to stay. Retailers are embracing digital commerce – while also starting to understand that the way they ‘do’ payment is more than a utility; it is a reflection of their brand values.

“Payments are no longer about simply completing a sale,” says Jeni Mundy, Global Head Merchant Sales & Acquiring at Visa in the Back to Business Study. “It’s about creating a simple and secure experience that reflects one’s brand across channels –– and provides utility to both the business and its customer.”

Download our Going fully for digital payments infographic.

Related content:

How traditional banks can counter neo-banks and fintechs with digital-first mobile services

7 game-changing innovations that will re-boot banking

A history of payment cards - from clay tablets to EMV cards (Infographics)