Why it’s time to modernise your payment card program

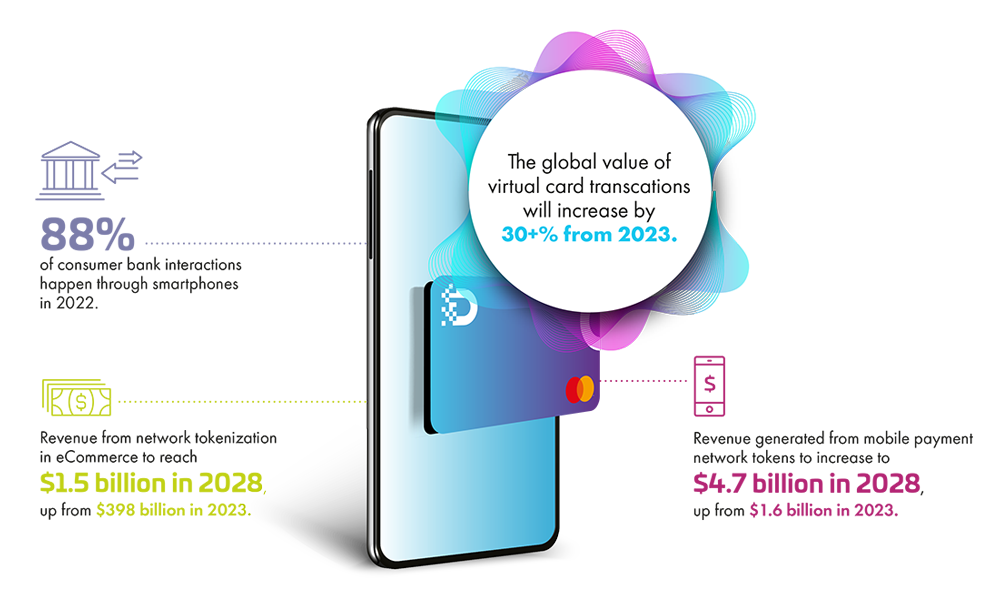

For card issuers, it’s time to modernise. Innovation is transforming the payments market. Fintechs are leveraging a new wave of digital-only, mobile-first and real-time services to revolutionise the way we make transactions online and in-person.

To stay relevant, banks, issuing processors and digital wallet providers need to modernise their card programs. Today’s consumers expect their banking app to put them in full control. That means offering them a seamless experience for ordering, setting up and using a fully personalised card and service portfolio. Physical, digital and virtual payment cards must be part of the same journey.

To put it simply, the mobile app is the new bank branch. If card issuers succeed in making their app a consumer favourite, they can supercharge engagement and drive the take-up of services. Card acquisition rates, transaction volumes and customer satisfaction are all boosted.

Choosing the right path to modernisation

Neo-issuers start with a blank page. They can go straight to cloud technologies and API-based infrastructures, creating the perfect springboard for innovative card experiences. But for existing card issuers with legacy systems, it’s a different story. Successful modernisation requires a two-step vision.

Initially, existing card and infrastructure elements are adapted to deliver new mobile experiences for customers. Cardholder journeys are improved through new digital card issuance and wallet provisioning services, and convenient lifetime management of physical cards. The

Thales Gemalto D1 modern issuance platform puts these quick wins within easy reach.

Attention then turns to redesigning the card issuing infrastructure itself and unleashing the full benefits of modernisation. Innovation readiness is built in. Complexity, cost and time-to-market delays are driven out of the development process. Thanks to the power of Thales D1, developers no longer have to deal with numerous APIs and stakeholders. Everything is integrated within a single UX-level API space.

Modern payment card programs are a win-win-win

Cardholders are in full control, free to choose the perfect card for any payment situation.

Card issuers boost their acquisition and transaction rates, while reducing online fraud with EMV tokenisation.

Merchants improve their online payment journey and conversion rates.

Taking the pain out of the payment card experience

We’ve all had a painful payment card experience. Let’s see how modern card programs rewrite the rules when things go wrong.

Lost your card when travelling abroad?

Now you can get a new card instantly , any time, any place

Don’t know when your new card will arrive in the post?

Remember when your card was shipped to the wrong address.

Card stolen?

Remember when your card was lost or stolen.

Forgotten your PIN?

Remember when you couldn't remember your pin code.

Innovating responsibly

Customers also expect their bank to act responsibly. Card issuers therefore need to demonstrate how they are caring for the planet, its resources and people. Card modernisation must consider not just convenience, but also environmental performance and financial inclusion.

At Thales, we believe everyone should benefit from innovation. We apply sustainability-by-design rules to all our offers. And we believe that digital technologies offer immense potential to empower customers and redefine accessibility in banking and payments.

Try Thales D1 Demo

Bring to life the digital first user journey. Discover for yourself how your customers can get the best mobile experience with instant digital card payment - online & in-store, while letting them have full control over their payment credentials.

Experience the customer journey

Thales: transforming the banking and payments experience worldwide

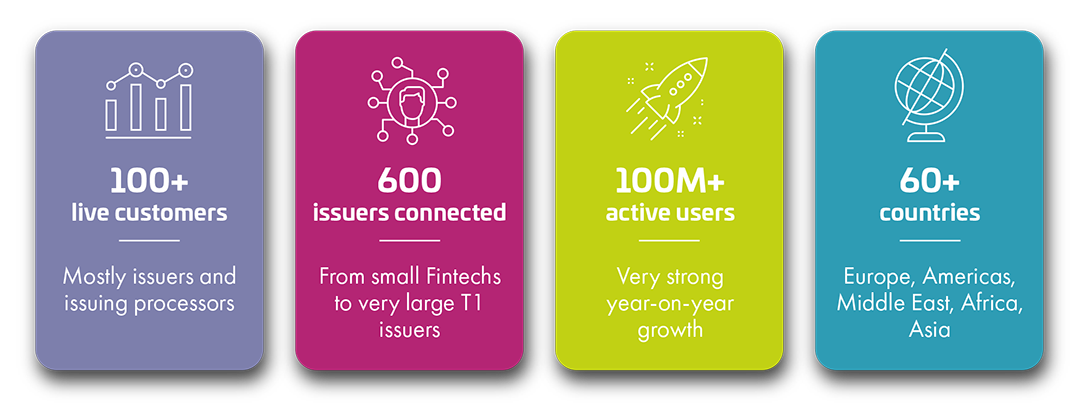

Thales, a global leader in banking and payment solutions, serves over 3,000 financial institutions worldwide. Our Thales Gemalto D1 solution embodies everything we know about delivering intuitive, secure and convenient customer experiences. To find out more….

More resources on modern issuing solutions and digital-first banking

John uses his virtual card for easy and secure online payments

- Strong Customer Authentication

- Secure display of the virtual card in the mobile app

Emily gets her digital card ready to use in a few seconds

- Instant digital card issuance

- Push to wallet

- Automated provisioning

Debbie receives her new digital card immediately and gets her physical card later

- Combined digital and physical card issuance

- Card order status and activation straight from the mobile app

Debbie controls her digital cards in real-time on her mobile

- Real-time management of digital cards

- Easy setting of payment domains and limits for all digital cards

The new technology trend: Thales card API for banks, issuing processors and wallet providers to deliver their modern card programs

Download our whitepaper

Five key reasons to roll out your digital first banking and payment services

Drive a convenient & mobile-centric experience to your customers with Thales Digital First.

Read our infographic on Digital First

How to measure success for a modern digital first card program deployment?

Read our infographic